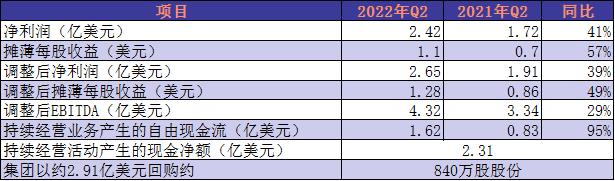

Latest News: On August 5th, Huntsman Group announced the results for the second quarter of 2022. In the quarter, the group achieved revenue of US$2.362 billion, net profit of US$242 million, and adjusted net profit of US$265 million. USD, Adjusted EBITDA of $432 million. In the first half of 2022, more than $500 million worth of shares will be repurchased.

Peter Huntsman Chairman, President and Chief Executive Officer

R. Huntsman said that Huntsman’s performance in the second quarter was due to the group’s business strategy of “focusing on value over sales”, properly adjusting product pricing and effectively optimizing costs. The EBITDA margin in the second quarter exceeded 18%. %. Despite the increasingly severe economic environment due to various unfavorable factors such as soaring natural gas prices in Europe, China’s epidemic control and tightening of monetary policy in the United States, the Group is confident to achieve or even exceed the targets announced at the “Investor Day” in November 2021 . In addition, the group repurchased shares worth about $500 million in the first half of the year. Huntsman’s solvency remains strong with a net leverage ratio of 0.6 times. In the coming months, Huntsman will continue to optimize costs, focus on downstream businesses and return capital to shareholders, regardless of adverse changes in the macroeconomic environment that affect the chemical industry. At present, the company’s solvency is strong, its cash flow is abundant, and its operating conditions remain sound. In the future, Huntsman will take advantage of this visible superiority to invest in core businesses at an opportune time.

Year-over-year performance analysis of each department

Polyurethane Division

Revenue in the Polyurethanes segment increased year-over-year in the quarter, primarily driven by higher MDI average selling prices, partially offset by the negative impact of lower volumes. MDI average selling prices increased across all Huntsman regions. The main reason for the decline in sales was the long-term lockdown in Shanghai and the corresponding reduction in market demand, which was partially offset by the positive impact of regular maintenance at the Rotterdam plant. Adjusted EBITDA for the segment increased, mainly due to higher MDI margins and access to insurance coverage, but was driven by lower sales volumes, a weakening of major international currencies against the U.S. dollar and lower investment income from minority-owned joint ventures in China Negative effects are partially offset.

Functional Products Division

Revenue in the Functional Products segment increased year-over-year during the quarter, primarily driven by higher average selling prices, partially offset by the negative impact of lower sales volumes. The increase in average selling price was mainly due to the implementation of the “excellent business plan” and the increase in raw material costs. The decline in sales was mainly due to the division’s adjustment of product mix based on market demand and business strategy. The segment’s adjusted EBITDA increased primarily due to higher revenue and product margins, partially offset by the negative impact of higher fixed costs.

Advanced Materials Division

Revenue in the Advanced Materials segment increased year-over-year in the quarter, primarily driven by higher average selling prices, partially offset by the negative impact of lower volumes. The increase in the average selling price was mainly due to the increase in raw material, energy and logistics costs and the improvement of the sales structure. The decline in sales was mainly due to the elimination of the lower-margin base resin business. The segment’s adjusted EBITDA growth was primarily driven by higher product selling prices and an improved sales mix.

Textile Dyeing Division

Revenue in the Textile Dyeing and Chemicals division decreased year-over-year during the quarter, primarily due to lower sales volumes, partially offset by the positive impact of higher average selling prices. The decline in sales was mainly due to the obsolescence of some products and weaker demand. The increase in the average selling price of products was mainly attributable to the increase in direct costs. Adjusted EBITDA for the segment was lower, primarily due to lower revenue, partially offset by the positive impact of an improved product mix.